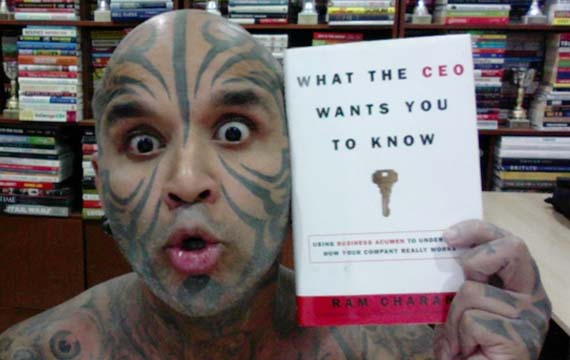

What The CEO Wants You To Know by Ram Charan – Loy Machedo’s Book Review

Editors Note:

This article is divided into the following:

- Ram Charan – An Introduction

- Loy Machedo’s Detailed Book Review

- Book Sections Explained

- Questions You Need To Ask Yourself As a Leader

- Terminologies Used By The Author

- Loy Machedo’s Book Review In A Nut Shell

- Loy Machedo’s Overall Rating

****************************

RAM CHARAN – AN INTRODUCTION

Ram Charan is the author of several books like:

- Boards At Work,

- Boards That Deliver,

- Every Business Is A Growth Business (with Noel Tichy),

- Know How and Execution (with Larry Bossidy and Charles Burck),

- Leaders At All Levels’,

- Leadership in the Era of Economic Uncertainty:

- Profitable Growth Is Everyone’s Business, Confronting Reality,

- Talent Masters,

- The New Rules for Getting the Right Things Done in Difficult Times,

- What The CEO Wants You To Know,

RAM CHARAN – A BUSINESS OWNER

Ram Charan is a business management consultant & owner of a consulting company under the name Charan Associates located in Dallas, TX earning over $1 Million USD in revenue. For a staff of only 4 people that is a very profitable business.

RAM CHARAN – A CONSULTANT

Ram Charan has been a consultant for GE, KLM, Bank of America, Praxair and Jaypee Associates.

RAM CHARAN – THE BOARD MEMBER

Ram Charan sits on the board for Austin Industries, SSA & Company (formerly Six Sigma Academy), and TE Connectivity.

RAM CHARAN & STEPHEN COVEY

Ram Charan partnered with Kevin R. Cope and Stephen M.R. Covey to form Acumen Learning.

RAM CHARAN & SADHGURU

In November 2012, Dr. Ram Charan, along with Sadhguru Jaggi Vasudev guided “Insight; the DNA of Success” a leadership program bringing together, for the first time, the tools of professional and personal empowerment. The 4-day program held at the Isha Yoga Center, saw 200 business leaders converge in an exploration that bridged spirituality and business.

RAM CHARAN – RECOGNITION

Charan was elected a Fellow of the National Academy of Human Resources in 2000 and named a Distinguished Fellow in 2005. Charan was in India in the month of February 2010 to give a presentation to around 400 Indian CEOs.

Fortune magazine calls him ‘the most influential consultant alive’.

****************************************

****************************************

(What The CEO Wants You To Know by Ram Charan

Loy Machedo’s Book Review Contd….)

****************************************

****************************************

LOY MACHEDO’S

DETAILED BOOK REVIEW

Let me share with you what I understood through Ram Charan’s book:

The book tries to explain the universal laws of successful businesses

STREET VENDOR VERSUS CEO

The author uses the analogy of a Street Vendor in India to the functions of a Successful CEO

A street vendor has the following roles every single day:

- They need to figure out what to buy based on what they think they can sell

- They need to figure out what price point to set the goods to. If they charge too high – no one will buy. If they charge too low, they will end up in a loss.

- A Street vendor never wants to take his goods back home because if his goods are taken back home – he will lose value especially if you consider foodstuff. And taking food back home with no cash is a serious problem

- The street vendor has to always put his best-selling goods in front so as to attract potential customers to his wares. At the same time, he has to put those goods forward which are not selling. He would always have to arrange the display.

- The measurement of success for a Street Vendor is knowing how many goods he has sold versus how much cash he has in own pocket.

- If goods are not sold or if he doesn’t have the liquid cash for refilling replenished stock – he would have to borrow some the next day.

- The biggest challenge that a street vendor has is to check his profit margins, to check his return on assets, to ensure customers buy the products and are kept happy and finally to ensure that they come back as repeat customers.

****************************************

****************************************

(What The CEO Wants You To Know by Ram Charan

Loy Machedo’s Book Review Contd….)

****************************************

****************************************

BOOK SECTIONS EXPLAINED

Section I – Business Acumen: The Universal Language of Business

Section II – Business Acumen in the Real World

Section III – Getting Things Done

*************

Section I – Business Acumen: The Universal Language of Business

KEY POINTS

- The best CEO is like a good teacher who can bring about clarity and remove the mystery & complexity of the business.

- The primary focus of any business leader is to focus on how to make money while retaining customers.

- Everything in business emanates from Return on investments, return on Assets

**************

Section II – Business Acumen in the Real World

KEY POINTS

- The world is complex, but leaders provide clarity

- Business leaders choose 3 to 4 business priorities.

- The priorities focus on retaining customers & cash generation

- A business priority defines undoubtedly the most important action that needs to be taken.

- Many business leaders falter because they become overwhelmed or become indecisive.

- Business leaders need to take decisions always.

**************

Section III – Getting Things Done

KEY POINTS

As you deliver results, your organization & its employees gain energy, confidence & resources to move ahead.

A good leader always does the following traits:

- harnesses the efforts of others

- expands their horizons

- synchronize efforts to get optimal results

- delivers consistent results day in & day out

- knows that there is no finish line

- inspire others to action

- determines & focuses on 3 to 4 business priorities

- places the right people in the right places based on their skills, attitudes & aptitudes

- have insight into people

- always thinks like a businessman

****************************************

****************************************

(What The CEO Wants You To Know by Ram Charan

Loy Machedo’s Book Review Contd….)

****************************************

****************************************

QUESTIONS YOU NEED TO

ASK YOURSELF AS A LEADER

TOTAL BUSINESS ASSESSMENT

- What is your assessment of the total business?

- What was your company’s sale during the last year?

- Are sales growing, declining or flat?

- What do you think about the sales picture?

- What is your company’s profit margin?

- Is your company’s profit margin growing, declining or flat?

- How does your company’s margin compare with its competitors?

- How does your company’s margin compare with other industries?

- Do you know what your company’s inventory velocity is?

- Do you know what your company’s asset velocity is?

- What is your company’s return on the asset?

- Is your company’s cash generation increasing or decreasing?

- Is your company gaining or losing momentum?

CUTTING THROUGH COMPLEXITY

- What is complex in your business?

- What are the external realities of your particular business?

- What are the things that can affect your company’s money making ability?

- Is there excess capacity in the industry?

- Is the industry consolidating?

- Do you face stiff pricing competition?

- How would your business be affected by currency fluctuations or changes in interest rates?

- Who are your new competitors?

- What is happening in your E-commerce?

- How would changes impact your company?

- What are the new trends in your industry?

- How can you help provide clarity and focus in cutting through the complexity to achieve key business objectives?

- How deep is your understanding of business fundamentals and how well do you apply them?

- How well do you prioritize business objectives, so resources and talents are best utilized?

PROVIDE FOCUS

- What are your business priorities at the moment?

- What are your 3 or 4 business priorities for your group, department or business?

- How do you combine this to enhance money making?

HELPING PEOPLE

- What are the 2 or 3 non-negotiable requirements of a new job now?

- What are the 2 or 3 non-negotiable requirements of a two to three years out?

- What are the 2 or 3 things you would need to enhance a person’s natural talent?

- What is the one major blind side of a person that would prevent him from growing further?

- How can you help people grow further? Achieve more?

- As a company are ideas and information being exchanged freely?

- What is the speed of decision making?

- What is the quality of decision making?

- Are the decisions taken – implemented? Working out?

- Are meeting constructive, destructive, a waste of time, energy building or energy draining?

****************************************

****************************************

(What The CEO Wants You To Know by Ram Charan

Loy Machedo’s Book Review Contd….)

****************************************

****************************************

DIFFERENT TERMINOLOGIES

USED BY THE AUTHOR

Money making in business has three basic parts:

- Cash generation,

- Return on assets

- Growth against future competition

Cash Generation

- Cash generation is the difference between the inflow and outflow of cash in a given period of time.

- Cash generation is the biggest challenge companies face.

- Many companies expand rapidly and though they are growing – they do not check their profitability index or profit meters and hence get bankrupt.

Return on Assets (ROA)

- To grow your business or start your business venture, you either have to use your own money or someone else’s. With this money, you buy inventory (raw-materials) or machinery (plant & equipment) or finished goods that you buy cheaper in bulk in a wholesale format to sell individually on a retail basis (credit).

Assets can be divided into two types:

- Tangible Assets – What you can touch

- Intangible Assets – Insurance

So the amount of money you can make through your assets is your Return on Assets.

Return on Assets (ROA) = Profit Margin (M) X Asset Velocity (V).

- The best companies have a return on assets greater than 10 percent after tax.

Asset Velocity (AV)

- The formula for asset velocity = Total Sales divided by Total Assets

- The faster the velocity the higher the return.

Inventory Velocity

- How many times does the inventory turn over in a year?

- If it is every day, it means good to have to be sold every single day. So the turnover velocity is high.

- So the more goods are sold, the better is it for the business.

- Storing and stacking good is bad for business as inventory costs go up. And that results in higher business costs.

Return on Investment or Equity

- It is the money or the equity that shareholders have invested.

Net profit margin:

- The margin is the percentage profit made on the sale of a company’s products/service.

- Total Sales MINUS The Cost MINUS all other costs MINUS interest MINUS taxes.

Price Earning Multiple or PE

- The ratio between the price for an individual share of stock and the earnings per share.

- A PE of 7 means that for every euro/dollar of earnings the stock is worth 7 times.

- The higher the PE more wealth is created.

- To know the health of a company – compare the PE Ratio of a company with the average one in the industry (S&P 500)

- If the industry has a higher PE than the company – the company is under-performing.

- If the industry has a lower PE than the company – the company is over-performing.

- When a company begins to miss its earnings-per-share expectation investors often decide to take their money elsewhere, resulting in sliding stock prices.

****************************************

****************************************

(What The CEO Wants You To Know by Ram Charan

Loy Machedo’s Book Review Contd….)

****************************************

****************************************

LOY MACHED’S BOOK REVIEW

IN A NUTSHELL

- Ram Charan’s Book “What the CEO wants you to know” is an attempt by the Author to educate people on how to successfully run a business.

- Although initially, I did find the book interesting when he used the intelligent analogy of a Street vendor versus a CEO, as the book progressed – it became nothing but a boring hash and rehash of overused phrases, definitions & management terms.

- His theory that “The higher the PE (Price Per Earning) more wealth is created” is flawed. I think he didn’t keep in mind about the Dot-Com Bubble & Eron.

- What the author stated in 137 pages, he could have easily expressed it in one single article. Let me give you the key points – Cash, Margin, Velocity, Growth on Assets.

- There are no case studies or examples to support anything the author states. The only examples he did have were GE & Ford – that too it sounded more of an advertisement than a factual case study.

- Ram Charan reminds me more of a college professor who has great theory but zero experience.

- The book at its best is just basic business elementary.

- The title is very misleading and there is nothing of value in the book.

- The book is poorly written and you will struggle to want to read it.

- Even though the author is educated and known for his one bestseller ‘Execution’ – this book is terrible.

****************************************

****************************************

(What The CEO Wants You To Know by Ram Charan

Loy Machedo’s Book Review Contd….)

****************************************

****************************************

LOY MACHEDO’S OVERALL RATING

Very poorly crafted, poorly researched and overpriced book. What starts out as incredibly interesting – moves to becoming really boring. There is nothing worthwhile you will get from this book apart from the flashy title.

I would give this book a 1 out of 10.

Loy Machedo

Who am I – http://www.whoisloymachedo.com/

My Services – http://thinkpersonalbranding.com/